Quick take

Ashok Leyland Ltd

BUY

Scrappage policy to drive faster growth

CMP

`139

Target Price

`163

Ashok Leyland Ltd (ALL) is the flagship company of the Hinduja Group, and one of the

Investment Period

12 Months

largest commercial vehicle manufacturers in India. ALL is engaged in the

manufacturing of commercial vehicles and related components. ALL’s products include

Stock Info

buses, trucks, engines, defense and special vehicles. Ashok Leyland offers a range of

Sector

Commercial Vehicles

products from 18 to 82 seater double-decker buses, from 7.5 to 49 tonne in haulage

Market Cap (` cr)

41,009

vehicles, from numerous special application vehicles to diesel engines for industrial,

Net Debt (` cr)

1,411

marine and genset applications. The company is headquartered in Chennai, India.

Beta

1.1

The company’s manufacturing facilities are spread across India with two facilities in

52 Week High / Low

144/81

Avg. Daily Volume

1,165,131

Prague (Czech Republic) and Ras Al Khaimah (UAE). It has operations in India, Sri

Face Value (`)

1

Lanka, Bangladesh, Mauritius, the Middle East and Africa.

BSE Sensex

33,317

Vehicle scrappage policy to trigger ALL’s growth: The government has introduced

Nifty

10,249

vehicle scrappage policy for commercial vehicles older than 15 years of age. The

Reuters Code

ASOK.BO

ministry is considering to incentivise fleet operators for scrapping old vehicles in the

Bloomberg Code

AL.IN

form of reduced tax rate on new vehicles. However, the quantum of concessions to be

offered for scrapping the old vehicles is in the process of finalisation and is expected to

Shareholding Pattern (%)

be out soon. As per the draft report, about 11 lakh MHCVs would qualify for

Promoters

51.3

scrappage, which provides huge opportunity for the industry (current industry size of 4

MF / Banks / Indian Fls

11.4

lakh units). ALL is leading MHCV player and in our view, ALL is set to capture the

FII / NRIs / OCBs

25.2

additional growth opportunity going ahead.

Indian Public / Others

12.1

Strong growth momentum in LCV business: Post GST rollout, LCV demand is picking

up strongly due to consolidation of warehouses (hub and spoke model). Moreover,

Abs.(%)

3m

1yr

3yr

Sensex

2.9

16.2

14.6

improved rural demand coupled with boom in e-commerce will drive LCV demand.

ALL

91.5

22.7

60.4

The LCV industry reported robust ~19% growth in 9MFY2018. Going ahead, we

expect growth momentum remain strong.

ALL to launch one product every six months: ALL plans to introduce a new product

every six months to widen offerings and fully harness the demand potential. Further,

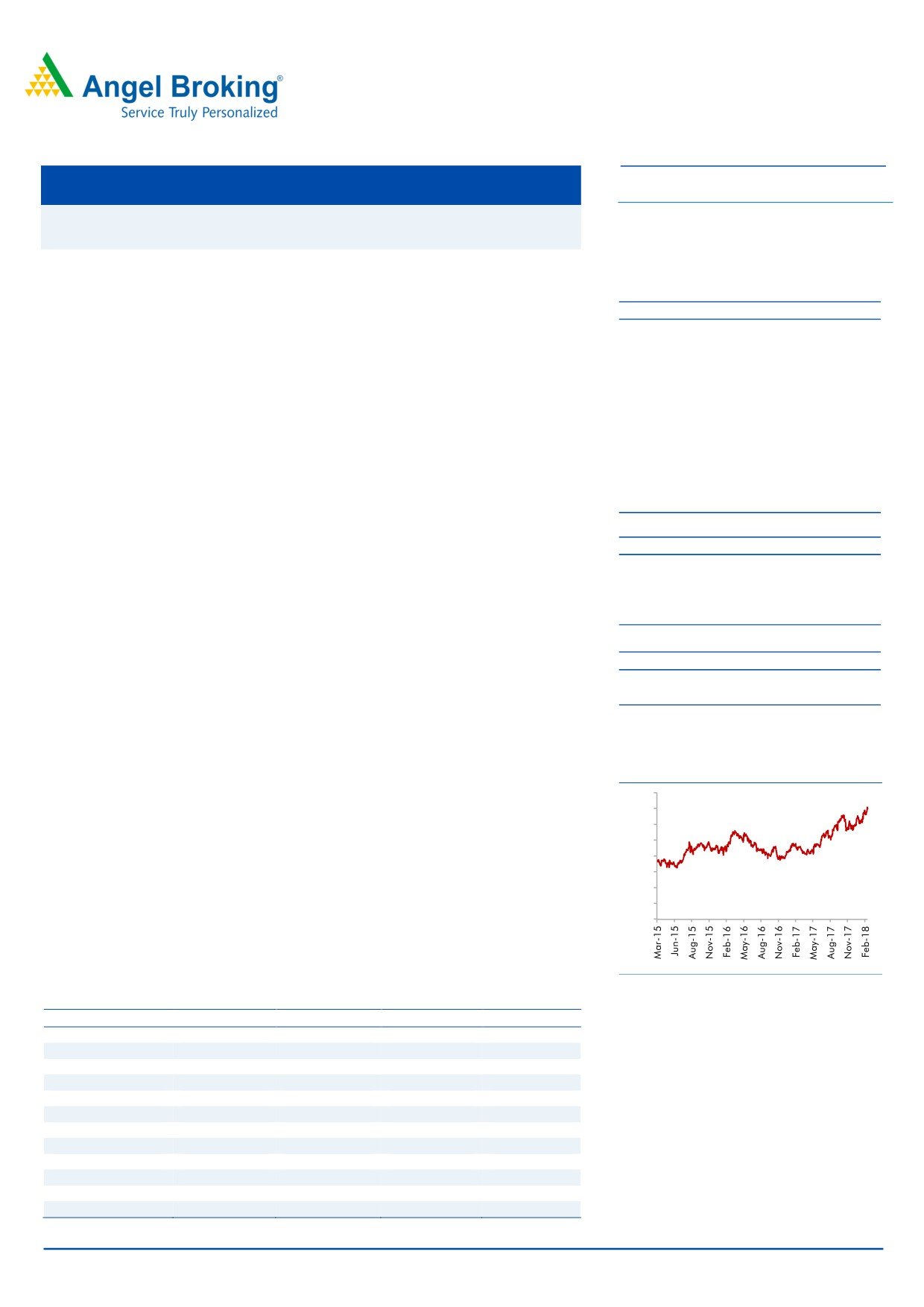

3-year price chart

apart from the domestic market, ALL is targeting to capture new export markets (which

160

were earlier restricted due to agreement with MNC partner) as well to tap the growth

140

120

opportunity.

100

Outlook and Valuation: We expect Ashok Leyland to report net Profit (reported) CAGR

80

of ~19% to ~`2,075cr over FY2017-20E mainly due to improvement in replacement

60

40

demand (implementation of vehicle scrappage policy, which opens huge opportunity

20

for ALL). At the CMP of `139, the stock trades at PE of 19.6x its FY2020E EPS of `7.1.

0

We initiate coverage on the stock with a Buy recommendation and Target Price of

`163 based on 23x FY2020E EPS, indicating an upside of ~17% from the current

levels.

Source: Company, Angel Research

Key financials (Standalone)

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

Net sales

20,019

26,119

30,728

35,279

% chg

5.7

30.5

17.6

14.8

Net profit

1,491

1,479

1,771

2,075

% chg

92.7

(0.8)

19.8

17.2

Amarjeet S Maurya

EBITDA margin (%)

8.4

10.3

10.3

10.3

022-39357800 Ext: 6831

EPS (`)

5.1

5.1

6.1

7.1

P/E (x)

27.3

27.5

23.0

19.6

P/BV (x)

6.6

5.6

4.7

3.9

RoE (%)

24.3

20.3

20.3

19.8

RoCE (%)

14.0

22.2

23.8

23.9

EV/Sales (x)

2.0

1.5

1.2

1.1

EV/EBITDA (x)

23.3

14.3

12.0

10.2

Source: Company, Angel Research, Note: CMP as of March 6, 2018

Please refer to important disclosures at the end of this report

1

Quick take

Ashok Leyland

Outlook and Valuation

We expect Ashok Leyland to report net Profit (reported) CAGR of ~19% to ~`2,075cr

over FY2017-20E mainly due to improvement in replacement demand (implementation

of vehicle scrappage policy, which opens huge opportunity for ALL). At the CMP of

`139, the stock trades at PE of 19.6x its FY2020E EPS of `7.1. We initiate coverage on

the stock with a Buy recommendation and Target Price of `163 based on 23x FY2020E

EPS, indicating an upside of ~17% from the current levels.

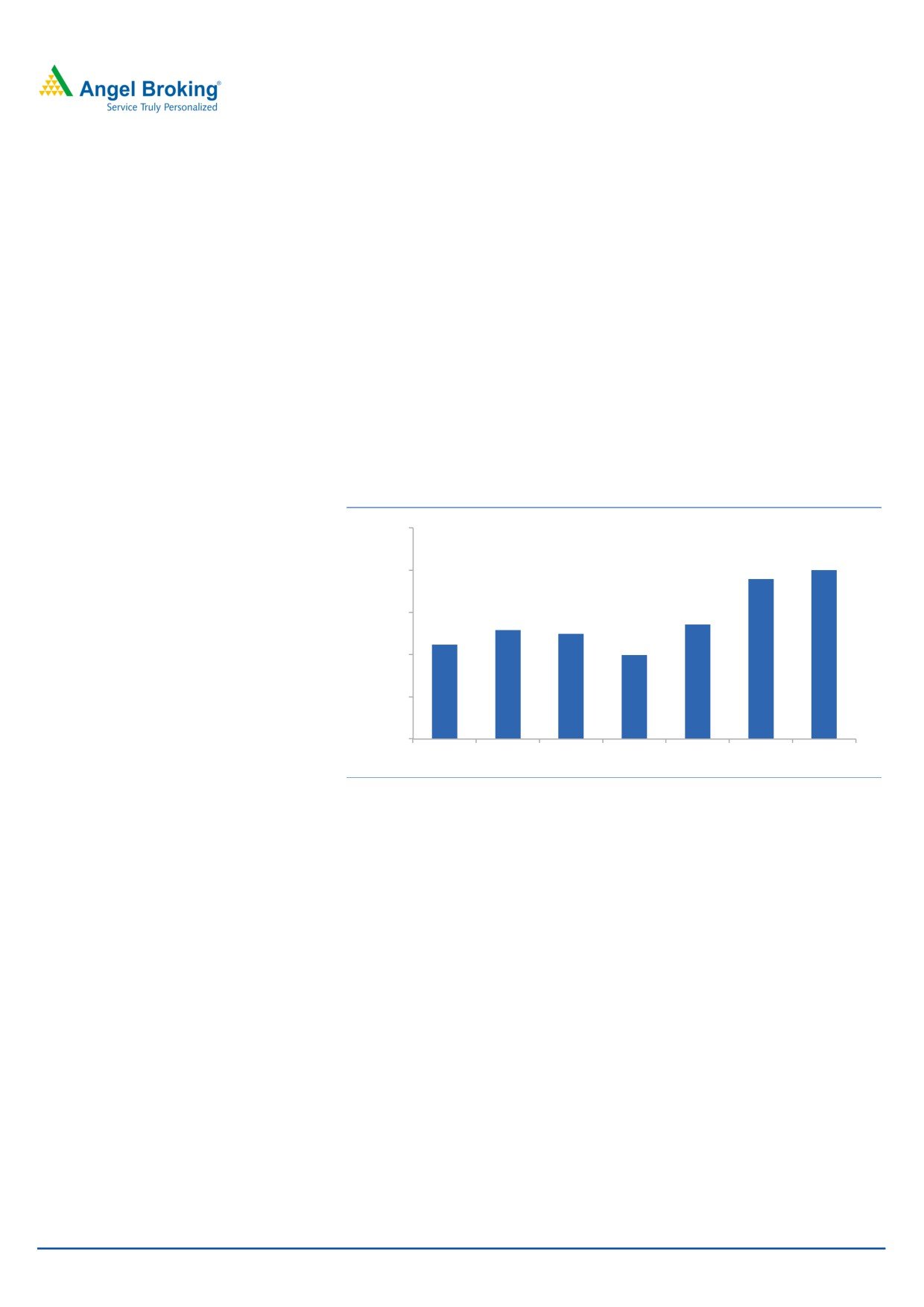

Exhibit 1: One year forward PE Chart

200

180

160

140

120

100

80

60

40

20

0

Share Price

10.0 X

15.0 X

20.0 X

25.0 X

30.0 X

Source: Company, Angel Research

Downside risks to our estimates

Slowdown in industrial activities could restrict sales volume for ALL

Delay in implementation of vehicle scrappage policy could restrict the

additional sales growth for company

March 07, 2018

2

Quick take

Ashok Leyland

Company Background

Ashok Leyland Ltd (ASL) is a holding company. The company is engaged in

commercial vehicles and related components. Through its subsidiaries, it is

engaged in manufacturing and trading in Medium and Heavy Commercial Vehicle

(MHCV), Light Commercial Vehicles (LCV), Passenger Vehicles (PV), automotive

aggregates, vehicle financing and engineering design services. It offers a range of

18 to 80 seater buses under categories such as city application and electric buses.

It offers a range of trucks, which includes long haul trucks, mining and construction

trucks, and distribution trucks. It designs, develops and manufactures defence

vehicles for armed forces. It offers Light Vehicles, which include DOST, PARTNER,

STiLE and MiTR. It offers power solutions for electric power generation, agricultural

harvester combines, earth moving and construction equipment and marine and

other non-automotive applications. It has operations in India, Sri Lanka,

Bangladesh, Mauritius, the Middle East and Africa.

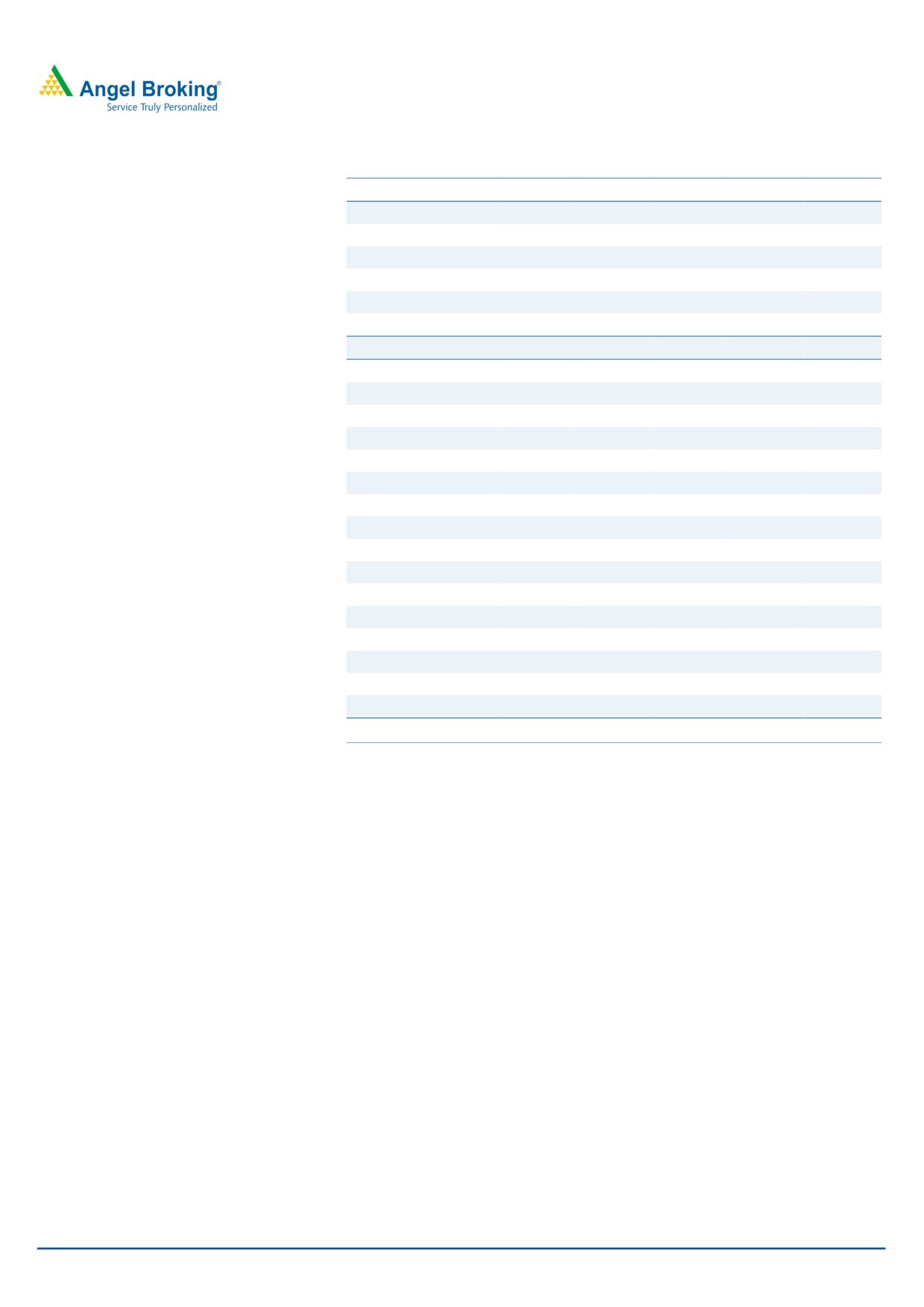

Exhibit 2: Historical CV Volume of ALL

25000

20,019

18,937

20000

15000

13,562

12,904

12,481

11,177

9,943

10000

5000

0

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017

Source: Company, Angel Research

March 07, 2018

3

Quick take

Ashok Leyland

Standalone Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Net Sales

18,937

20,019

26,119

30,728

35,279

% chg

39.6

5.7

30.5

17.6

14.8

Total Expenditure

17,498

18,341

23,429

27,563

31,645

Raw Material

13,195

13,973

18,675

21,970

25,225

Personnel

1,385

1,543

2,142

2,520

2,893

Others Expenses

2,918

2,825

2,612

3,073

3,528

EBITDA

1,439

1,677

2,690

3,165

3,634

% chg

79.4

16.5

60.4

17.6

14.8

(% of Net Sales)

7.6

8.4

10.3

10.3

10.3

Depreciation& Amortisation

488

518

573

615

652

EBIT

952

1,160

2,118

2,550

2,982

% chg

146.4

21.9

82.6

20.4

16.9

(% of Net Sales)

5.0

5.8

8.1

8.3

8.5

Interest & other Charges

248

155

154

149

140

Other Income

123

326

165

165

165

(% of PBT)

14.8

24.5

7.8

6.4

5.5

Recurring PBT

827

1,330

2,129

2,567

3,007

% chg

86.9

60.9

60.0

20.6

17.2

Tax

437

107

660

796

932

(% of PBT)

52.9

8.0

31.0

31.0

31.0

PAT (reported)

390

1,223

1,469

1,771

2,075

Extraordinary Items

(384)

(268)

(10)

-

-

ADJ. PAT

774

1,491

1,479

1,771

2,075

% chg

199.5

92.7

(0.8)

19.8

17.2

(% of Net Sales)

4.1

7.4

5.7

5.8

5.9

Basic EPS (`)

2.6

5.1

5.1

6.1

7.1

Fully Diluted EPS (`)

2.6

5.1

5.1

6.1

7.1

% chg

199.5

92.7

(0.8)

19.8

17.2

March 07, 2018

4

Quick take

Ashok Leyland

Standalone Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

285

285

285

285

285

Reserves& Surplus

5,123

5,841

6,995

8,441

10,190

Shareholders Funds

5,407

6,126

7,280

8,725

10,475

Total Loans

2,415

2,145

2,250

2,000

2,000

Deferred Tax Liability

753

741

741

741

741

Total Liabilities

8,575

9,012

10,271

11,466

13,216

APPLICATION OF FUNDS

Gross Block

5,279

5,858

6,458

6,758

7,258

Less: Acc. Depreciation

487

887

1,460

2,074

2,726

Net Block

4,792

4,971

4,998

4,684

4,532

Capital Work-in-Progress

76

206

206

206

206

Investments

1,980

2,879

2,879

2,879

2,879

Current Assets

5,925

5,744

8,472

10,727

13,613

Inventories

1,625

2,501

3,506

4,293

5,123

Sundry Debtors

1,251

860

1,360

1,768

2,223

Cash

1,593

912

1,516

1,900

2,740

Loans & Advances

712

709

1,045

1,383

1,764

Other Assets

745

762

1,045

1,383

1,764

Current liabilities

4,623

5,402

6,898

7,643

8,629

Net Current Assets

1,303

342

1,574

3,084

4,985

Deferred Tax Asset

424

614

614

614

614

Mis. Exp. not written off

-

-

-

-

-

Total Assets

8,575

9,012

10,271

11,466

13,216

Source: Company, Angel Research

March 07, 2018

5

Quick take

Ashok Leyland

Standalone Cashflow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

390

1223

2129

2567

3007

Depreciation

488

518

573

615

652

Change in Working Capital

(179)

190

(627)

(1127)

(1061)

Interest / Dividend (Net)

203

88

0

0

0

Direct taxes paid

(441)

(348)

(660)

(796)

(932)

Others

1223

484

0

0

0

Cash Flow from Operations

1683

2155

1425

1259

1666

(Inc.)/ Dec. in Fixed Assets

34

(366)

(600)

(300)

(500)

(Inc.)/ Dec. in Investments

330

(1111)

0

0

0

Cash Flow from Investing

364

(1477)

(600)

(300)

(500)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

(789)

(883)

105

(250)

0

Dividend Paid (Incl. Tax)

(154)

(325)

(325)

(325)

(325)

Interest / Dividend (Net)

(263)

(151)

0

0

0

Cash Flow from Financing

(1205)

(1359)

(220)

(575)

(325)

Inc./(Dec.) in Cash

842

(681)

604

383

840

Opening Cash balances

751

1593

912

1516

1900

Closing Cash balances

1593

912

1516

1900

2740

March 07, 2018

6

Quick take

Ashok Leyland

Key ratios

Y/E March

FY2016

FY2017

FY2018E FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

52.6

27.3

27.5

23.0

19.6

P/CEPS

46.4

23.4

19.9

17.1

14.9

P/BV

7.5

6.6

5.6

4.7

3.9

Dividend yield (%)

0.4

0.8

0.0

0.0

0.0

EV/Sales

2.1

2.0

1.5

1.2

1.1

EV/EBITDA

27.5

23.3

14.3

12.0

10.2

EV / Total Assets

4.6

4.3

3.8

3.3

2.8

Per Share Data (Rs)

EPS (Basic)

2.6

5.1

5.1

6.1

7.1

EPS (fully diluted)

2.6

5.1

5.1

6.1

7.1

Cash EPS

3.0

5.9

7.0

8.1

9.3

DPS

0.5

1.1

0.0

0.0

0.0

Book Value

18.5

20.9

24.9

29.8

35.8

Returns (%)

ROCE

12.2

14.0

22.2

23.8

23.9

Angel ROIC (Pre-tax)

22.4

25.9

41.2

42.9

43.5

ROE

14.3

24.3

20.3

20.3

19.8

Turnover ratios (x)

Asset Turnover (Gross Block)

3.6

3.4

4.0

4.5

4.9

Inventory / Sales (days)

31

46

49

51

53

Receivables (days)

24

16

19

21

23

Payables (days)

50

56

53

50

50

Working capital cycle (ex-cash) (days)

6

5

15

22

26

March 07, 2018

7

Quick take

Ashok Leyland

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Ashok Leyland

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 07, 2018

8